Accelerating global Just Transition with three core strengths.

We create projects with our Financing Power, deliver them through to commercial operation with our End-to-End Execution Power, and fuel the next wave of investment and regional development with our Profit-Return Power. We design this virtuous cycle and prove it with results.

Our target counties

31 JCM Partner Countries and Our Priority Markets

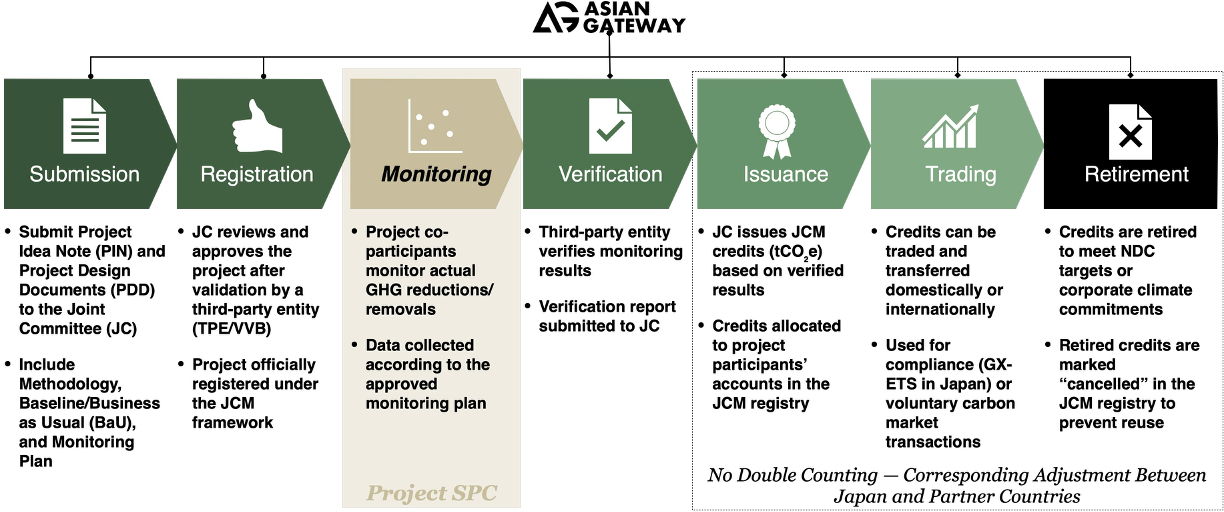

The Government of Japan has been holding consultations on the Joint Crediting Mechanism (JCM) since 2013 and has established the JCM with the following partner countries.

Asian Gateway focuses on Japan and the Global South, in particular:

Southeast Asia (Cambodia, Viet Nam, Thailand, Indonesia, the Philippines, Malaysia),

Central Asia (Türkiye, Mongolia, Uzbekistan, Kazakhstan),

South Asia (Sri Lanka, India, Bangladesh),

the Middle East (Saudi Arabia, the United Arab Emirates (UAE)),

South America (Chile, Costa Rica, Brazil, Peru),

and Africa (Kenya, Tanzania, South Africa).

JCM Partners

31

JCM (Joint Crediting Mechanism) partner countries led by the Government of Japan

As of October 2025

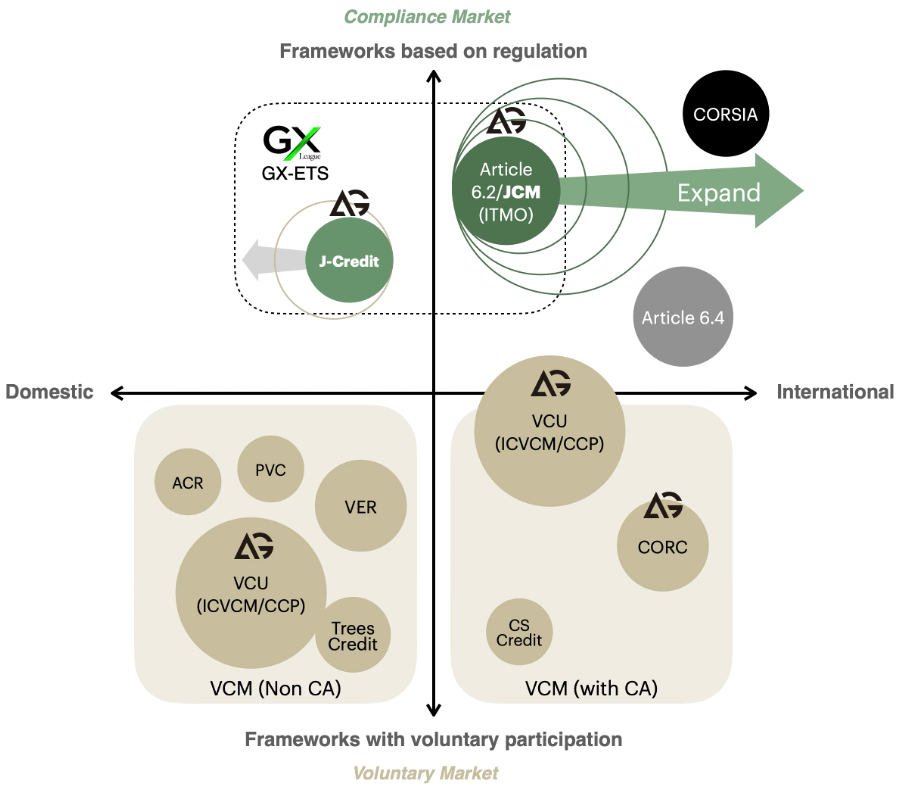

Carbon Credit Market Map

We propose "usable credits" tailored to our clients' objectives for disclosure and compliance, connecting them to results in the most direct way.

- Domestic: We build on a solid foundation of J-Credit and GX-ETS for domestic compliance needs.

- International: We focus on Article 6.2/JCM for international compliance and expand according to demand.

- Voluntary Market: We provide optimal proposals centered on high-integrity VCUs and removal-based credits (CORC).

- Future Frameworks: We are also prepared to support future frameworks, including CORSIA and Article 6.4.

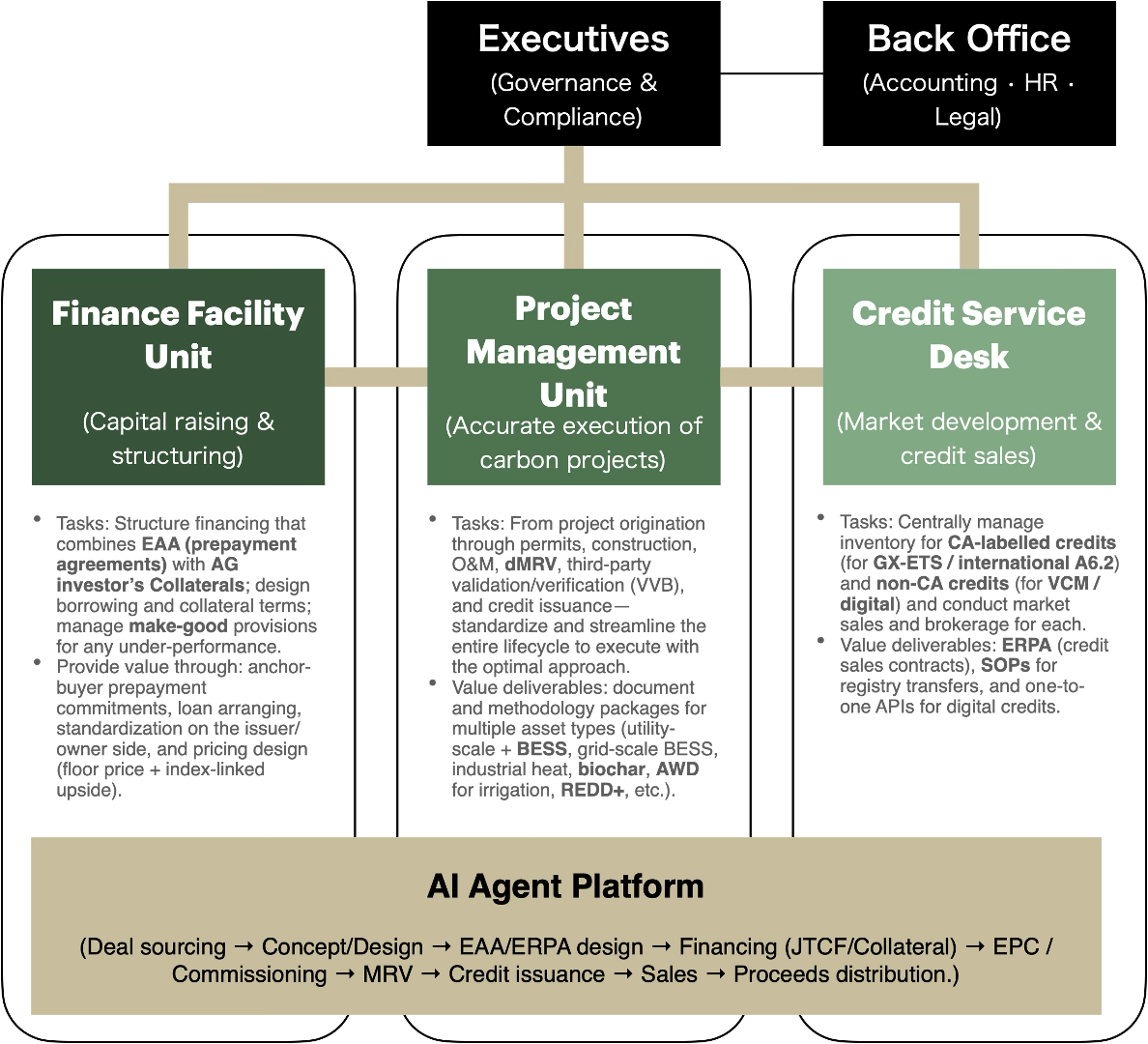

Our Three Core Services

Finance Facility Service

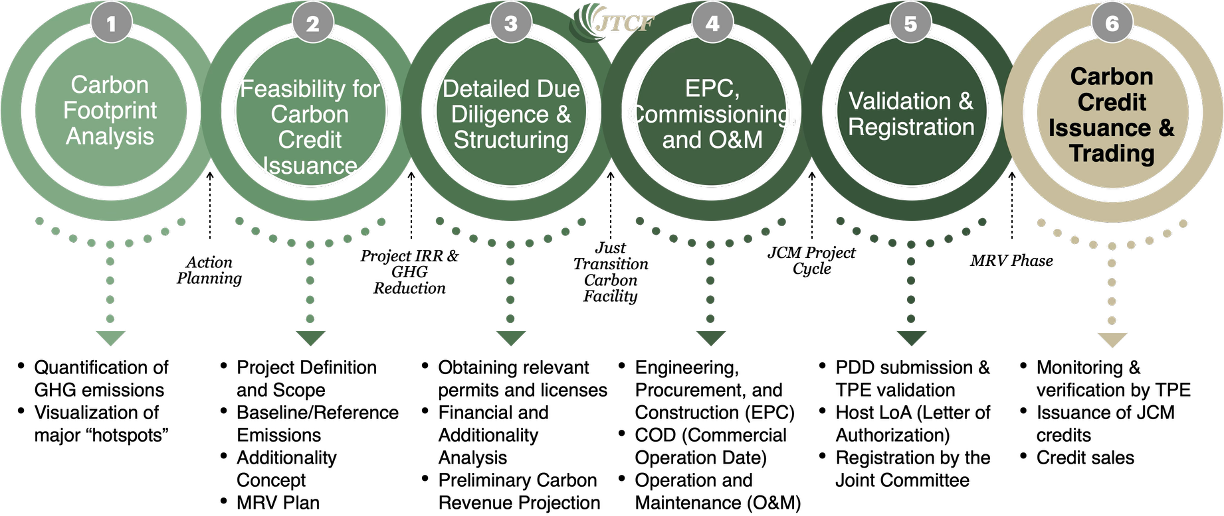

Our Finance Facility Service is a financing platform for real-economy projects such as renewable energy, energy efficiency, biochar, and wind power.

- Structuring: We support SPC (Special Purpose Company) formation, DSRA (Debt Service Reserve Account) design, and credit enhancement, including SBLCs.

- Use of Funds: Covers EPC costs, equipment procurement, installation & commissioning, O&M, and spare parts.

- Source of Repayment: Cash flow from PPAs and other offtake agreements, plus revenue from issued credits (with potential for index-linked upside).

- Operational Transparency: Issuance and settlement are based on dMRV data and compliant with third-party verification.

- Result: We increase the speed of business launch and the certainty of financing, providing financial backing through to the creation of high-quality credits that are "measurable, traceable, and explainable."

We will propose the optimal financing structure tailored to your project's scale and country-specific requirements.

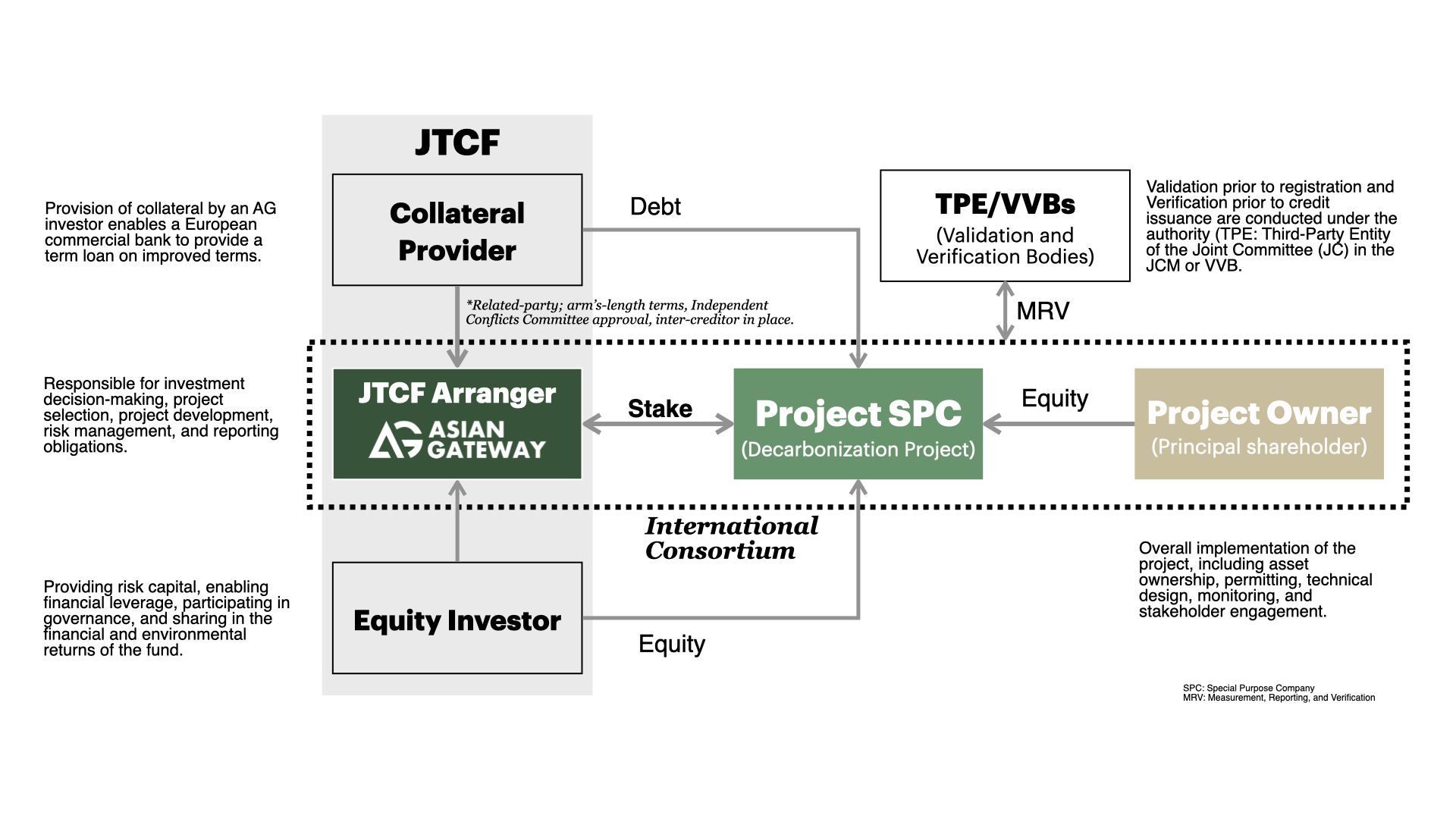

A financial hub that channels capital into decarbonization projects,

driven by trusted data and robust methodological design through the JTCF.

At its core, the JTCF (Just Transition Carbon Facility) is an integrated finance platform that mobilizes funding for carbon credit projects—bridging decarbonization and a just transition.

Project Management Service

Our project management provides integrated oversight from project origination through to credit issuance and the distribution of proceeds after commercial operation.

- Planning & Design: Feasibility studies/basic design, CAPEX/OPEX estimation, schedule development (critical path management)

- Permitting & Stakeholder Coordination: Grid connection, environmental impact/HSE, land acquisition, JCM-related procedures (LoA/Corresponding Adjustments, etc.)

- Execution Management: EPC bidding, contracting, quality & safety management, construction supervision, commissioning & performance guarantees

- Data & Quality: dMRV design & implementation, VVB engagement, registry registration, and delivering "measurable, traceable, and explainable" outcomes

- Operations & Improvement: O&M optimization, KPIs/dashboards, change management, incident response & prevention

- Result: We mitigate delays, cost overruns, and quality defects to deliver real-world decarbonization effects and high-quality credits on schedule.

We will propose the optimal project plan tailored to your project's scale and country-specific requirements.

Development & Implementation based on International Consortium Agreements

AG acts as arranger and orchestrator, coordinating stakeholders to deliver JCM-based decarbonization projects—through financing, permitting, MRV, and credit issuance. We are not consultants who offer a single service. We are a strategic partner who supports our clients' challenges from the concept of decarbonization to the monetization of the value created, consistently supporting project realization and value maximization. Asian Gateway accelerates global decarbonization with three core strengths.

Credit Service Desk

Our Credit Service Desk is responsible for market development and sales of the high-quality carbon credits we generate, maximizing value for our clients.

- Inventory Management & Market Strategy: We centrally manage inventory for CA-labelled credits (for GX-ETS/international A6.2) and non-CA credits (for VCM/digital) and conduct market sales and brokerage for each.

- Standardization of Contracts & Transactions: We provide ERPA (credit sales contracts) and SOPs for registry transfers to realize smooth, transparent transactions.

- Stable Supply & Compliance: We ensure a long-term supply of high-quality credits with stable pricing and delivery terms , and we provide support for our clients' disclosure and audits.

- Digital Integration: We offer one-to-one APIs for digital credits to ensure traceability and reliability.

- Result: By navigating the complexities of the carbon market, we propose and deliver optimal credit portfolios that help our clients achieve their compliance and sustainability goals.

We will propose the optimal credit types and ERPA tailored to your specific needs.

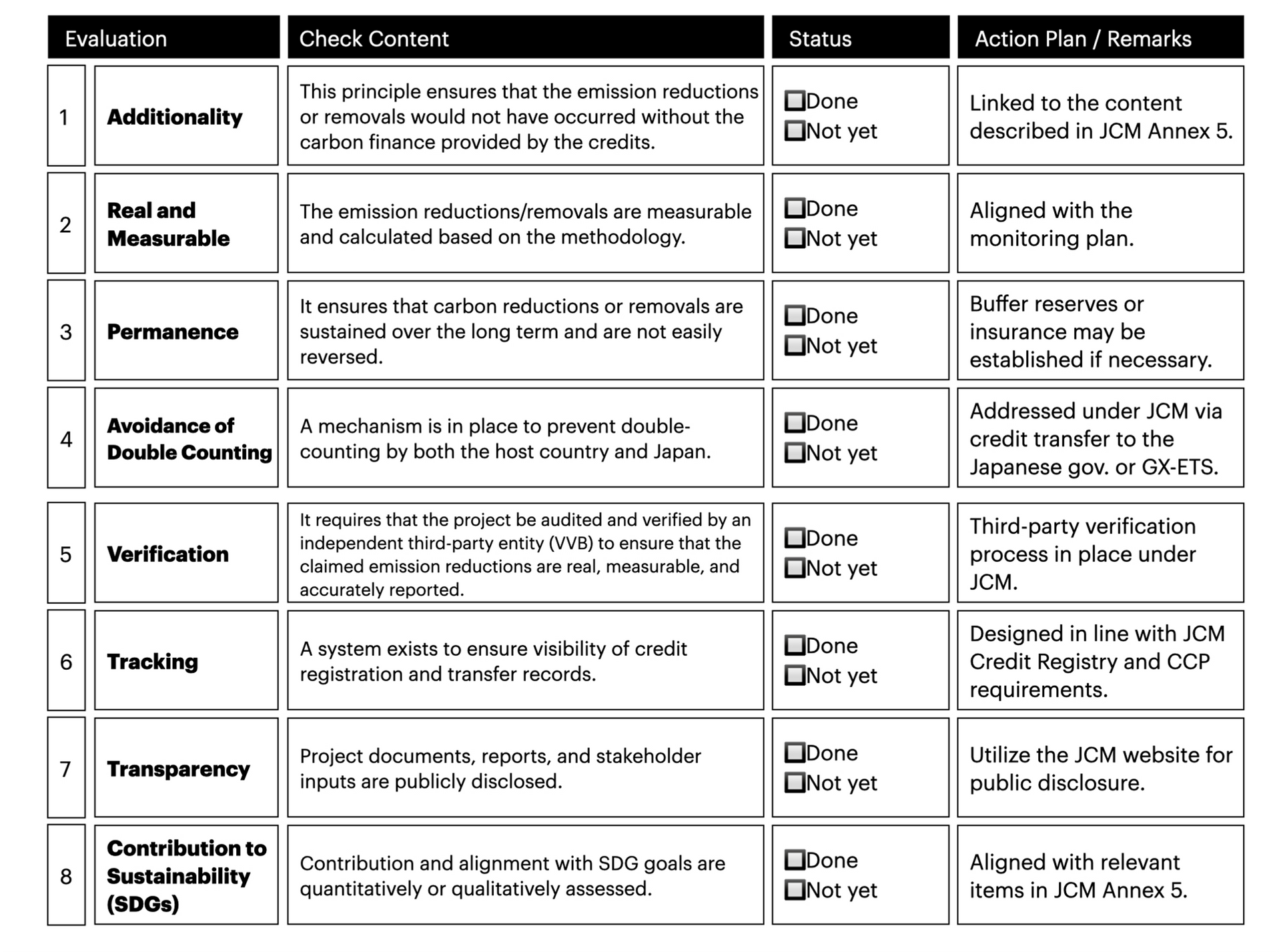

Project Evaluation Checklist

JTCF-backed projects are designed to meet JCM requirements and align with ICVCM’s CCPs (Core Carbon Principles), enabling multi-market eligibility—subject to host LoA/CA, program criteria, and current rules (e.g., GX-ETS).